Paycheck Lite : Mobile Payroll app for iPhone and iPad

Developer: Payrollguru, Inc.

First release : 11 May 2011

App size: 4.63 Mb

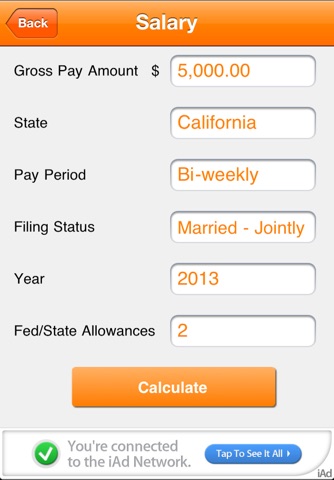

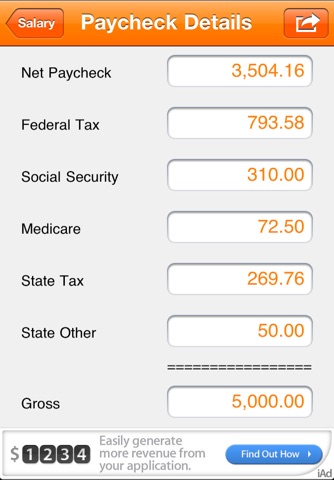

Paycheck Lite computes your payroll check from a Gross payroll amount or calculates Hourly Wages, that may include overtime and double time. Paycheck Lite calculates net paycheck amount and applicable federal and state payroll taxes, such as federal withholding tax, social security, medicare, state withholding, state unemployment and state disability (where applicable).

Paycheck Lite is an ideal tool for anyone looking to estimate net pay (take-home amount after taxes) in the state of employment. Use Paycheck Lite to calculate payroll check on a go and to compare net paychecks in 50 different states and US territories, especially if considering employment in a different state or a possible relocation.

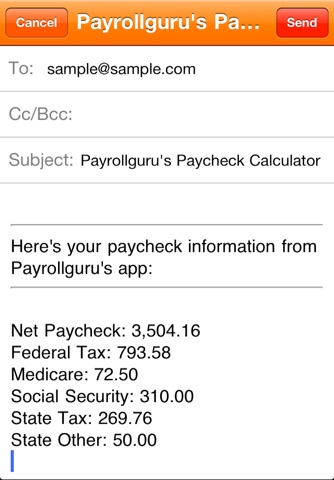

Paycheck details can be emailed to employee, employer, payroll service provider, spouse or anyone else. Use Paycheck Lite to estimate your net paycheck amount and budget your spending accordingly.

Paycheck Lite mobile payroll app considers federal and state deduction allowances, current year to date wages paid, and federal and state filing statuses - details that affect accuracy of calculation. For professional payroll app and paycheck calculation consider upgrading to paid Payrollguru app, which allows for multiple employees payroll profiles, pre-tax and post-tax deductions, and displays a pie chart distribution of a gross paycheck.

Paycheck Lite is available for iPhone, iPod and iPad. Thank you for using Paycheck Lite! If you enjoy using the app please review it, otherwise please send us your comments, suggestions and bug reports to [email protected].

Latest reviews of Paycheck Lite : Mobile Payroll app for iPhone and iPad

Looks good but its only good for the united states. If I could use I would have given it a 5 star but since I have no use for it, it gets 1 star!

Will only use to calculate federal. Otherwise not accurate.

Not sure why all the great reviews. It doesnt tell you amount per paycheck-at least it didnt for me getting paid semi-monthly. And the calculated amount was WAY off from what Im actually getting each paycheck. Ive been using payckeckcity.com for a while and it works pretty good.

Horrible, the calculations are wrong

For some reason when I paste an amount with a comma the app just drops what is after the comma. The calculations seem okay but I havent compared them to my paystub yet.